Our investment groups often remark that they recognise the high responsibility of investing the assets on behalf of the collegiate University, to support the activities of an educational institution nearly 1,000 years old.

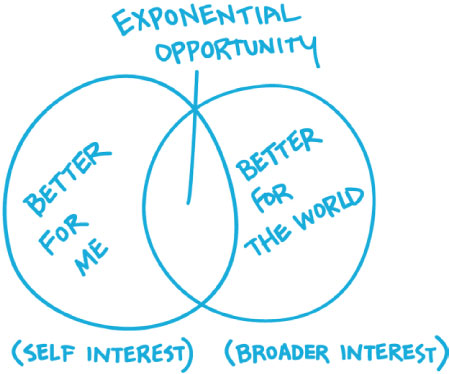

One group that we work with, based in New York, has actively sought to articulate its own social mission throughout its investment process. Their aim is to work at the intersection of ‘for-profit and for-good’ and they have taken leadership in this space. The group recognises the power of clearly stating these purposes in attracting employees and customers for underlying businesses, as well as entrepreneurs and like-minded investors.

The group is looking to back start-up businesses in the innovation space and, as a venture capital group, the group falls into our private equity allocation. We have invested in several of the group’s funds since 2013. Funding early stage businesses requires a small pool of capital and this means that the capacity available to investors is very limited, but we have also made co-investments alongside the group in specific businesses, where more investment is required.

The returns when funding innovation can be over a longer period than tolerated by a conventional investor but, with our long term time horizon, we can support the identification of the start-up businesses of today, which will become the most innovative and successful businesses of the future across a variety of sectors. Examples include businesses involved in crowdfunding for start-ups, software to link scientific research with the corporate world, and the supply of affordable broadband to local communities.

We are very pleased to be one of the largest investors in this pioneering group. Importantly for us, alongside its social mission, the group has the characteristics that our experience shows make for successful long term investments. The small team is a founder managed partnership, which demonstrates a clear alignment of interests with investors by significantly committing alongside them in the funds. The manager has proven their ability to engage with underlying companies to operationally improve and help them grow in a sustainable manner. We have an open dialogue with the group and a high degree of transparency into the underlying positions, including a seat on the Limited Partners Advisory Committee. Importantly, the group continues to generate investment returns that are additive to the Oxford Endowment Fund’s mission of supporting education and research.